Spirit Airlines is on the verge of filing for bankruptcy following the collapse of its proposed merger with Frontier Airlines. The airline, which operates on a low-cost model offering affordable base fares with paid add-ons, has been grappling with mounting financial challenges, including over $1.1 billion in debt and significant operational losses. After Frontier backed out of the merger discussions, Spirit’s share price plummeted by over 60% within an hour, reflecting investor uncertainty about the company’s future.

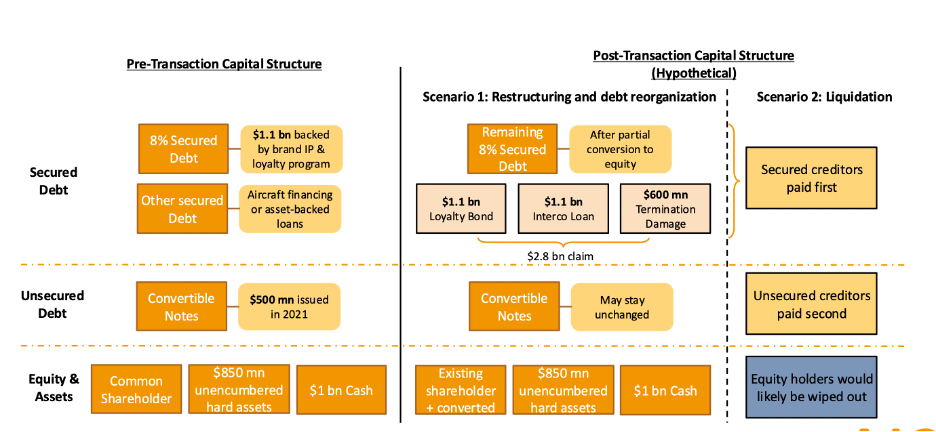

To address its dire financial situation, Spirit has been negotiating a restructuring plan with bondholders. If the plan moves forward, it will likely result in the complete loss of equity for shareholders, while general creditors are expected to remain unaffected. The restructuring comes as Spirit struggles to manage high operational costs and intense competition in the budget airline space, which have severely strained its ability to generate sustainable profits. Despite selling assets and scaling back growth plans, the airline’s financial obligations, particularly as it nears its debt maturity deadlines, have left it in urgent need of a turnaround.

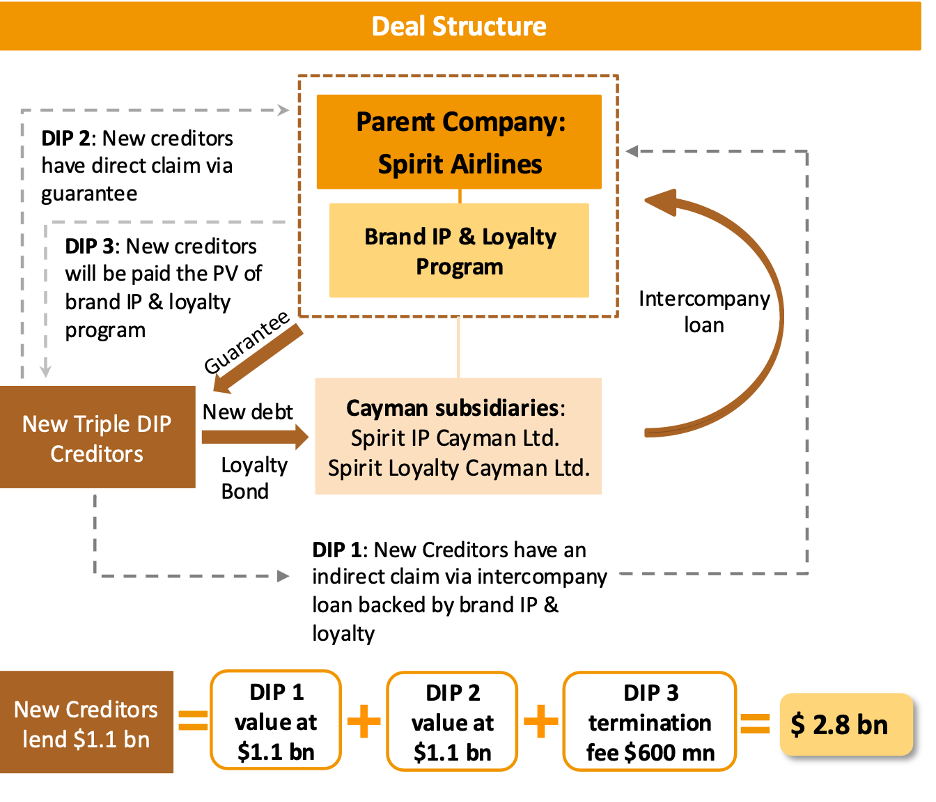

The proposed restructuring plan is unprecedented and involves a “triple dip” financing structure, a first in corporate history. This complex arrangement centers on Spirit’s 8% secured notes, backed by its loyalty program and brand intellectual property (IP). In a “triple dip” structure, the first two tiers of refinancing involve intercompany loans and parent company guarantees, as seen in double-dip financing structures. The unique third tier, however, is secured by the debt indenture of the loyalty program itself. If the brand IP is terminated, Spirit will face an additional $600 million termination fee. This innovative but risky approach inflates the company’s liabilities from $1.1 billion to $2.8 billion, creating significant claims against its assets and raising concerns about its ability to emerge from bankruptcy sustainably.

Spirit’s situation underscores the harsh realities facing the budget airline industry, where rising costs and competitive pressures can quickly destabilize even established players. Whether the triple-dip restructuring plan succeeds will depend on the approval of bondholders and the airline’s ability to navigate the complex financial and operational hurdles ahead.